Pipelines and Oil Tankers: The Economic Cost and Risk to BC and its Coast

14 November 2013

Update: A video has been presentation has been made available. Please view the updated post Video Presentation - Pipelines and Oil Tankers: Economic Cost and Environmental Risk.

There are two major oil pipeline projects proposed for BC: Enbridge’s Northern Gateway, and Kinder Morgan’s Trans Mountain expansion.

This is an opportune time to reflect on Canada’s energy strategy and whether oil pipelines and tanker traffic along BC’s coast are in our public interest.

This question is complex. But my experience is that when thoughtful people are provided good and full information they make sound decisions.

Unfortunately, when it comes to oil sands extraction and export, we are given only part of the story. We are provided the picture the industry wants us to see.

Like Enbridge’s missing islands in the Douglas Channel, we are given a false narrative about the risks—and the costs.

This is the way Enbridge presented the Douglas Channel in their promotional video for Northern Gateway.

This slide shows us what Enbridge left out.

Tonight I am going to fill in missing parts of the picture. I am going to talk about the economic implications of the current oil sands strategy.

I am going to discuss what it will mean if we do not push back and redirect, not only the flow of oil—but also the flow of influence, decision-making and power.

I was born and raised in Vancouver and grew up playing at Jericho Beach and Spanish Banks. I can remember seeing maybe a cargo ship, or two, a week in English Bay waiting to be loaded.

Now it’s about a dozen a day. And with Kinder Morgan planning more than 400 oil tankers a year filling up with diluted bitumen at their Westridge terminal in Burnaby, I am troubled by the visual pollution this means for English Bay. English Bay will be turned into a supertanker parking lot for Kinder Morgan.

As many of you, I am also troubled by the threat of a heavy oil spill.

But even if there is never a spill, environmental costs related to Green House Gas emissions and water usage from oil sands extraction, upgrading, refining and use, are huge.

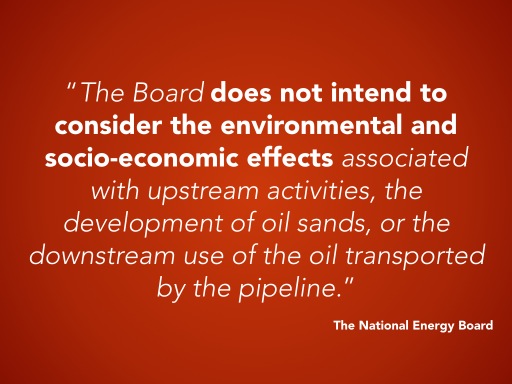

What many of you may not know is these environmental costs are not considered as part of the environmental assessment process undertaken by the National Energy Board.

The NEB’s terms of reference for both Northern Gateway and Trans Mountain’s expansion exclude any environmental costs related to getting the oil out of the ground (that phase is referred to by the industry as upstream activity).

The terms of reference exclude environmental impacts from processing bitumen into petroleum products (what the industry refers to as downstream activity).

And the terms of reference exclude the environmental impact from gas, jet fuel and diesel when they burn and are released into the atmosphere.

The recently released NEB Scope of Issues for Trans Mountain’s expansion explains these exclusions.

So, what is of concern to many of us—the life cycle environmental impact of oil sands exploitation—is missing in the Federal review process.

This review process is supposed to determine whether these oil pipeline projects are in the public interest.

How can it effectively fulfill this task with a large part of the public interest concern excluded from their assessment?

When asked about the limited definition of environmental impact, the NEB defers to assessments done by the Alberta government when they approve oil sands producers’ plans.

By not having a Made in BC environmental review for these projects we abdicate effective decision-making control not only to the Federal government, but to the Alberta Government as well.

This evening I will focus on issues that can be considered by the NEB.

I will address whether or not bitumen export pipelines and increased oil tanker traffic make economic sense for Canada and Canadians, particularly here in British Columbia.

After all it is British Columbians and BC’s First Nations that are being asked to hand over the most for big oil’s big bottom lines.

Let me begin by being clear about who is running the show.

Canada’s energy strategy is determined in the boardrooms of a handful of corporations and by the governments of foreign countries through their state-owned oil companies.

The strategy is communicated to the Federal and Provincial governments through closed-door meetings with lobbyists and at state dinners over dessert in foreign countries.

It is supported by legislative changes that reduce environmental protection and public participation.

The multinational oil strategy is forced on the Canadian public through misleading narratives and misrepresentation of facts—whether from pipeline companies, oil sands producers and refiners, their lobby groups, or their bankers.

They consistently exaggerate the benefits, deny the costs and underplay the environmental risk.

Since our needs and concerns are inconvenient—we are viewed with contempt.

If necessary—we are demonized.

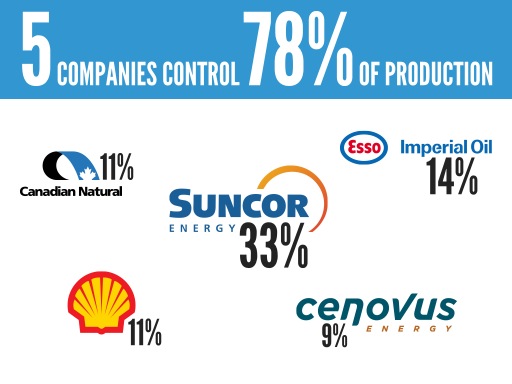

Who are these oil sands companies?

Five multinational oil companies control 78% of current oil sands production. These companies are Suncor, Imperial Oil (whose parent is Exxon Mobile), Shell, Canadian Natural Resources and Cenovus.

Even though some of these companies have head offices in Calgary, they are multinationals and hence respond to interests that are not necessarily compatible with ours.

For example Suncor operates refineries in the US and has oil assets in countries like Lybia and Syria. Cenovus, in partnership with Conoco Phillips, jointly owns refineries in the US. Imperial and Shell are foreign owned

And the other oil companies with oil sands interests are relatively new actors, not yet producing large volumes, and they are primarily state owned.

These national oil companies—we would call them crown corporations—are Norway’s Statoil, and China’s Sinopec, Petro China and the Chinese National Offshore Oil Company (CNOOC) which now owns Nexen.

These companies acquired significant oil sands resource rights over the past 8 -10 years and plan on playing a significant role.

So what is big oil’s plan for us?

They want to rapidly extract oil sands heavy crude called bitumen, mix it with imported diluent to allow it to flow through pipelines and export it as diluted bitumen to the US Gulf Coast along Keystone XL, to Asia along Northern Gateway and Trans Mountain’s twin and to eastern Canada for export to Asia and India along Energy East.

This wasn’t always the plan. As recently as 2008 Alberta’s multinational oil producers planned to invest in upgrading and refining here in Canada ensuring the oil sector grew along with the extraction of raw resources.

These projects would have taken Alberta’s already strong downstream activity up a notch, stabilized the industry and securely established a domestic value-added supply chain.

In fact, when running for re-election in 2008 Prime Minister Harper promised that bitumen would not be exported to Asia but would be upgraded to Synthetic Crude Oil.

He promised this because upgrading means value added wealth, meaningful jobs and control over environmental standards.

His government continued to publicly support upgrading oil in Canada right until Enbridge filed its application for Northern Gateway. But Harper’s promises obviously did not concern big oil.

Exporting raw bitumen is not good for Alberta’s value added and it’s not good for the environment—its only good for a handful of very large companies. And these companies got their way.

The negative economic implications of a strategy based on rapid extraction and export of bitumen are staggering.

But, today, you won’t hear anything about the economic costs from Ministers of the Government of Canada, who instead of protecting the public interest have become marketing executives for the oil industry.

Instead of working to protect the public interest, they work with industry to create fear in uniformed Canadians that if we don’t hurry up and approve these bitumen export pipelines, economic opportunities will be lost.

They try to avoid transparency and accountability by setting up a false dichotomy.

Heavy crude oil pipelines are not a competition between economic gain versus environmental, cultural and social cost. This is a fabricated trade-off developed by oil interests to pit ordinary Canadians against ordinary Canadians.

They hope our fear of economic loss if we don’t approve these pipelines, is greater than our fear of environmental, social and cultural harm if we do.

Canadians need to become better informed about the real economic consequences of bitumen export pipelines.

When we do, the extensive economic costs become obvious and the real picture emerges.

The real picture is bitumen export will bring significant environmental, social and cultural harm AND economic harm as well.

To put it simply: when it comes to non-renewable resources, rapid extraction and export is exploitation, not economic development.

Development means enhancement, value added, improvement—some form of contributing to a better state because of economic activity.

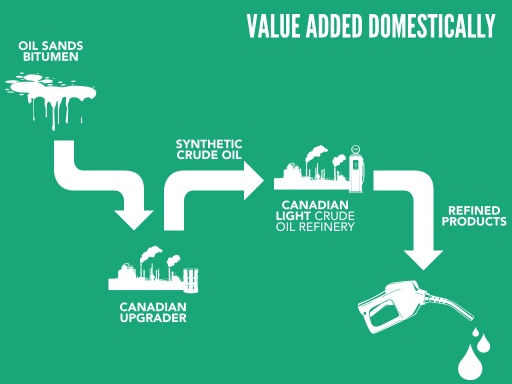

There are essentially two things to do with bitumen once it comes out of the ground.

The first option is to upgrade bitumen to Synthetic Crude Oil—called SCO—so it can be refined to become petroleum products like gasoline and jet fuel.

This option is the value chain that benefits Canada and our economy as illustrated by this slide.

OR:

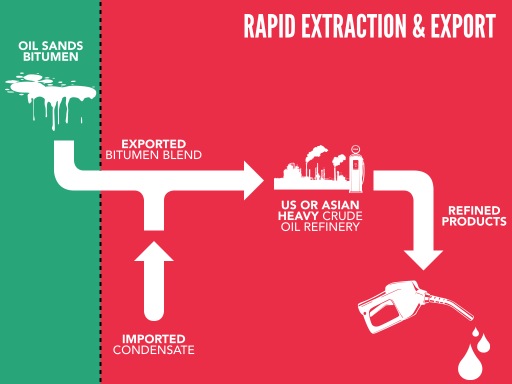

The second option—the one the oil sector is pursuing with the Harper and Alberta’s government’s active support—is dilute bitumen with a substance, like condensate, to move it down a pipeline for upgrading and refining in foreign markets.

Option two is not development—any more than a cannibal learning to eat with a knife and fork is progress.

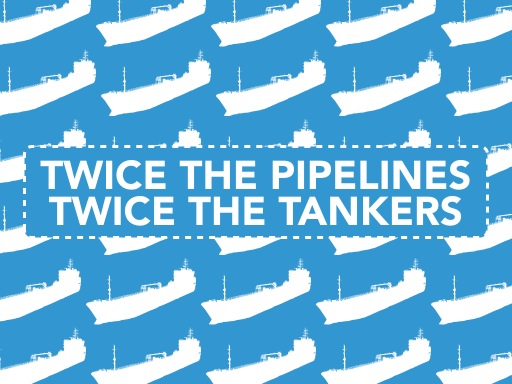

The oil sector’s strategy is exploitation. They plan to rapidly extract and export raw bitumen and build twice the pipeline capacity, and require twice the oil tankers, than if value was added in Alberta.

This approach will deliver a worsened economic, social, environmental and cultural reality to BC, Alberta, and Canada.

That is the truth and it is not anti-business, or anti-industry.

It is a fact.

If you extract and export raw bitumen diluted with condensate, only 35 percent of the value of our resources is captured within our economy—the rest of the value is shipped down the pipeline along with the jobs and environmental standards, along with the wealth and government revenue.

Upgrading bitumen captures 70 percent of the value of our oil sands heavy crude.

While refining it to end user products captures 100 percent of the value in our economy.

Now, we’ve all been told the story that its uneconomic to build upgraders or refineries in Canada. We are led to believe that if it were, then big oil would be doing it.

What we aren’t told is that a number of upgraders and refineries were planned for Alberta right up to the financial crisis in 2008.

What we aren’t told is that the US heavily subsidizes it refineries allowing them to invest in facilities that can handle bitumen and ensure that the value added occurs in the US.

What we aren’t told is that under the 1975 Energy Policy and Export Act the US protects its energy industry by restricting the export of crude oil.

By requiring crude oil produced in the US be refined before it can be exported the economic strength of the US economy is enhanced.

Can you imagine how strong Canada’s oil resource sector would be under a similar law?

What we aren’t told is that environmental standards in Asia are significantly lower than in Canada and big oil can avoid Canadian standards by shipping diluted bitumen there.

Now, I’d like to discuss what bitumen exports mean for oil prices in the Canadian economy.

For almost two years Enbridge told us the benefits from Northern Gateway would come from higher prices paid in Asia for our oil.

Pipeline proponents and elected leaders like Minister of Natural Resources Joe Oliver, told us this would contribute economic benefits to Canada.

What they didn’t tell us, and what my evidence filed with the National Energy Board disclosed, was that they plan to charge higher Asian prices on every barrel produced and sold in Canada every year for not one year, or five years—but every year for 30 years.

When refineries pay higher prices for their feedstock, they pass these price increases on. That’s the primary purpose behind accessing new markets—get the highest price possible for one barrel and pass it onto all barrels.

So whenever you are told access to foreign markets secures higher prices for our raw crude and this benefits Canada, you also need to know oil producers plan to charge those higher prices on every barrel they produce.

And when they do, their refineries pass it onto us right here at home.

The market access Canadians need for western Canadian crude is in eastern Canada. That’s a demand of about 750,000 barrels a day.

Quebec and the Atlantic Provinces are almost completely dependent on foreign crude oil imports from volatile and uncertain markets—the same markets we are told China is trying to protect itself from by importing our crude.

These refineries in eastern Canada pay higher prices for their imports because they are priced off an international benchmark called Brent.

But, most Canadian refineries, especially in the east, cannot process oil sands bitumen. This means it needs to be upgraded in Alberta to Synthetic Crude Oil—into SCO—if it is going to be used by eastern refiners like Suncor, Imperial Oil, Valero, or Irving.

None of the proposals for pipelines eastward guarantee western Canadian oil will go into eastern Canadian refineries and displace foreign imports.

An eastern pipeline proposal becomes just another bitumen escape route out of Canada for oil companies.

Unless Canadian energy self-sufficiency is a stated government policy, and bitumen is upgraded in Alberta first, big oil’s plans will cannibalize our economy.

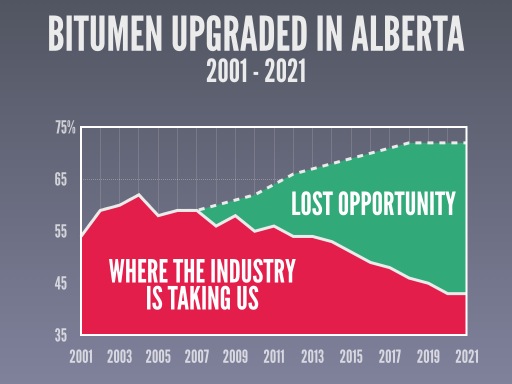

Traditionally, Alberta upgraded about 60% of the bitumen pulled out of the ground. In 2007 the Alberta government promised the rate would rise to 72% bringing with it the benefits of value added, meaningful jobs, and greater tax revenue.

Then came the financial crisis and the upgrading projects were scrapped—in Canada.

In the US investments in upgrading and refining were made—including investments made by Canadian oil producers such as French multinational Total, Cenvous, and Husky. These investments were made to accept Canada’s bitumen.

So instead of a Canadian upgrader, we get Keystone XL—a bitumen export pipeline to the United States.

As this graph explains, oil company decisions to invest in refineries in the US to accept our bitumen, and their plan to do the same in Asia, has already started to hollow out Alberta’s resource sector. The percentage of bitumen upgraded in the province has begun to decline.

By 2017 Alberta will only upgrade 48% of the bitumen it produces and by 2025 it will be less than 40%. That’s a long way away from where we would have been when Alberta promised 72% of the bitumen would be upgraded in Alberta by 2016.

Because bitumen is so dense, like tar or wet cement, in order for it to flow down a pipeline it requires diluent, like condensate. Condensate is a high quality oil by-product from natural gas and shale oil.

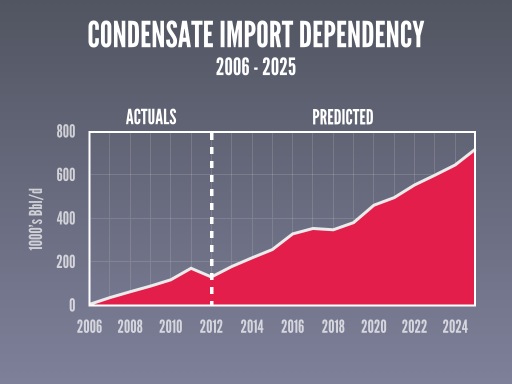

Up until 2005 Canada was self-sufficient in condensate production. When we produced a barrel of bitumen and mixed it with domestically produced condensate to make diluted bitumen, we exported a barrel of diluted bitumen—or what the industry refers to as dilbit.

Not true any more.

By 2006 condensate demand began exceeding domestic supply. Oil sands producers started importing it from the US.

The rapid extraction and export of bitumen strategy—the cannibalization strategy—requires a growing import dependency for condensate, as this slide clearly represents.

And, to import condensate you need pipelines. That’s why Enbridge reversed its Southern Lights oil export pipeline in 2010—to import condensate.

That’s why Kinder Morgan is reversing its Cochin pipeline to flow from Illinois in the US to Alberta.

The need for more condensate import pipelines is why the Enbridge Northern Gateway project includes a twin pipeline—one dedicated to import condensate from the Middle East.

But the untold real clincher with big oil’s strategy—as if a growing reliance on imports from the Middle East is not enough—in order to export dilbit instead of upgrading bitumen in Alberta, more than twice the pipeline capacity is required.

That’s right more than twice the pipeline capacity.

Why twice?

You need the pipeline to bring condensate in, and when you mix it with bitumen at a ratio of 30% condensate to 70% bitumen, you need the same amount of pipeline capacity to export the condensate back out.

This is why for example, Kinder Morgan’s 300,000 barrel a day existing Trans Mountain pipeline—which ships about 60,000 barrels a day of diluted bitumen—can become a 350,000 barrels a day pipeline if they dedicate it to carry only light oil. Lighter oil like SCO, is less costly and quicker to move than diluted bitumen.

If Trans Mountain didn’t ship diluted bitumen today, its likely Chevron wouldn’t need to import 6,500 barrels a day by more expensive rail.

Enbridge’s Northern Gateway is intended to transport 525,000 barrels a day of crude oil and 193,000 barrels a day of imported condensate.

This triggers an average of 220 Aframax, Suezmax and Very Large Crude Carriers—220 a year in the Douglas Channel and Hecate Straight.

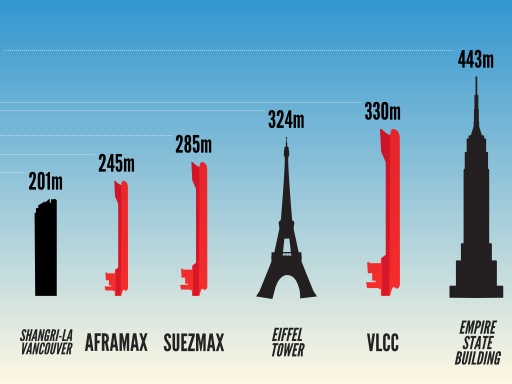

As this slide shows these are very large vessels—even the Aframax that now docks at Trans Mountain’s Burnaby terminal is taller than the Shangri La—Vancouver’s tallest building.

The capacity of Northern Gateway’s throughput, and the tanker traffic it triggers is pretty common knowledge.

What is not commonly appreciated is that Northern Gateway has been designed to ship 60% more crude oil and 40% more condensate by simply adding pumping power.

The supertankers needed to transport it? Well its not 220 a year, but closer to 340—almost two supertanker transits a day in BC’s northern coastal waters.

More crude. More condensate. More Tankers. More Risk. Way more risk.

Spill risk is not additive. If there are 60% more oil tankers there is more than a 60% increase in the risk of an oil spill.

None of that expanded capacity risk is being considered in the current approval process for Northern Gateway, but capital expenditures to support expanded throughput are in its budget.

Once approval for Northern Gateway is given—which the Federal Government has clearly led us to believe it will be—the oil industry is counting on less scrutiny and rapid approval to expand throughput through a streamlined regulatory process.

Kinder Morgan already understands the benefits of this streamlined regulatory process because it relied on it when it expanded capacity about seven years ago.

Until 2005 Kinder Morgan’s Trans Mountain pipeline capacity was 225,000 barrels a day. In 2005 and 2006 they applied for expanded capacity to 300,000 barrels a day under an expedited review process.

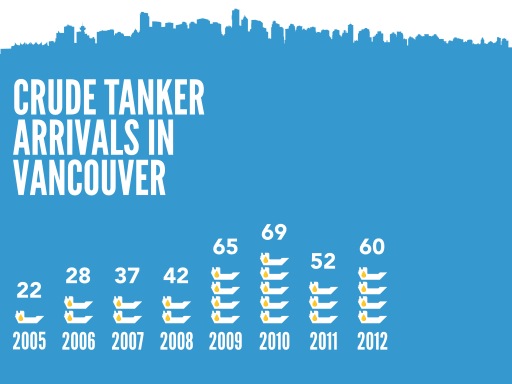

A growth in oil tanker traffic in Burrard Inlet was triggered.

The number of oil tankers through English Bay has increased three fold since Kinder Morgan expanded Trans Mountain’s pipeline capacity.

At no time has an adequate terrestrial and marine environmental assessment been conducted on this increased volume, nor has the unique risk presented by diluted bitumen been assessed.

Costs from a spill have not been calculated and adequate financial resources to compensate for a spill are not assured.

If BC’s five requirements for considering heavy oil pipelines were applied to the existing Trans Mountain pipeline, the transport of diluted bitumen would immediately be stopped.

The current economic risk from the existing Trans Mountain system is extensive and the British Columbian public is exposed to unnecessary risk.

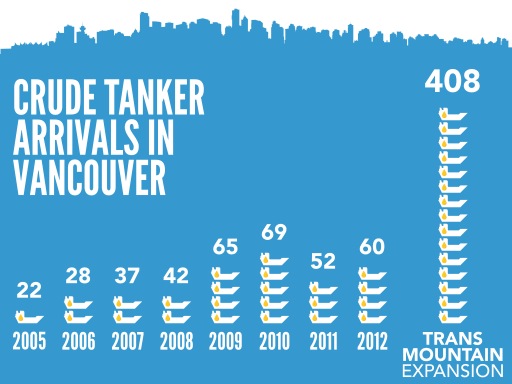

Now, Kinder Morgan plans to twin Trans Mountain and they have told us their new pipeline will ship 540,000 barrels a day of diluted bitumen triggering 408 tankers a year.

This proposed new pipeline is a 36” diameter pipeline—the same diameter as Northern Gateway’s proposed oil pipeline.

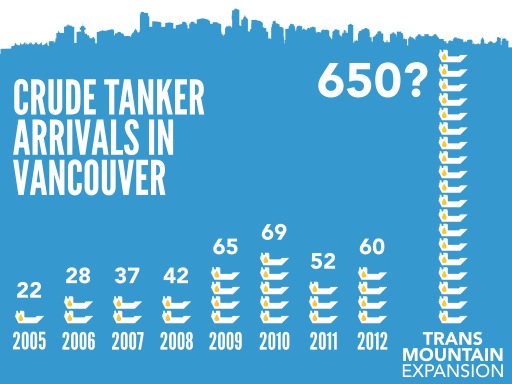

It is possible that the proposed Trans Mountain twin is designed with much greater throughput capacity than what we are being led to believe.

If this new pipeline can move up to 850,000 barrels a day as Northern Gateway can, this would mean the oil pipeline system flowing into the lower mainland could accommodate over 1.2 million barrels a day of crude oil.

That volume would mean either more supertankers—or bigger supertankers—or both.

We know in 2011 Kinder Morgan planned to dredge Burrard Inlet to accommodate Suezmax supertankers which can ship about 25% more oil than Aframax—because they are bigger.

Kinder Morgan have now said they have abandoned that scenario—but it doesn’t mean they won’t bring it back down the road.

So in summary, the “The Top 10” economic costs of oil pipelines and supertankers are:

Decades of higher oil prices for Canadian consumers and businesses across the country;

Lost opportunity to add value, create meaningful jobs and control environmental standards here at home;

Hollowing out of the oil sector as raw bitumen exports take precedence over domestic upgrading and refining;

Continued reliance on foreign oil imports through eastern Canada;

A growing dependence on foreign condensate imports through western Canada;

Crowding-out of BC’s legitimate and vibrant economic activity;

Twice the number of pipelines and double the tanker traffic to move diluted bitumen as compared to upgraded bitumen;

More than twice the environmental risk and related costs;

As soon as Northern Gateway and Trans Mountain are approved, more pipeline capacity will be demanded without appropriate environmental assessment; and

Supernatural British Columbia becomes a Supertanker terminal for Alberta.

Big oil’s rapid extraction and export strategy makes no economic sense—it only makes business sense for a handful of companies and their shareholders.

Crude oil pipelines through British Columbia make no economic sense.

Oil tankers threatening our coast make no economic sense.

We need to develop an energy policy in Canada, Made in Canada, for and by Canadians.

This is not what big oil wants, but it is what our country needs.

We have to say “no” to these pipelines and “no” to oil tankers along our coast.

We have to say “no” to corporate plans that crowd out British Columbia’s economic development and put at risk our domestic economy and existing jobs.

And when British Columbians stand behind a firm “no” to oil pipelines and a firm “no” to oil tankers along our coast what we are really saying is a definite “yes”.

“Yes” to a better future for BC, for Canada and all Canadians.

Thank-you

Photo Credits:

1: flickr.com/photos/bognar/4020930219/

4: flickr.com/photos/kashmera/3679933265/

6: flickr.com/photos/kashmera/3679927915/

19: Dan Phelps danielphelps.ca/

26: flickr.com/photos/jason_lacey/5342839751/

27: kindermorgan.com/investor/presentations/2011_Analysts_Conf_05_KM_Canada.pdf